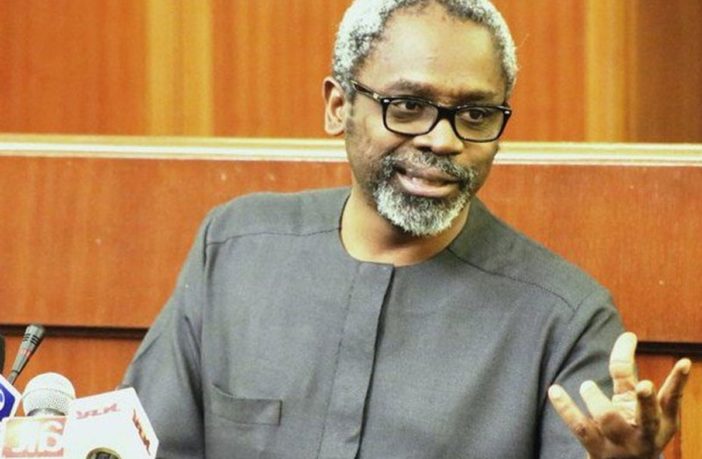

House of Representatives Speaker, Hon. Femi Gbajabiamila on Monday in Abuja called for integrity and transparency in the management of pension funds.

Gbajabiamila made the call during a three-day public hearing/investigation held for stakeholders on the non-remittance of pension contributions by the employers.

The public hearing was also to investigate delays of nonpayment of pension entitlements to retirees by pension fund administrators, non adherence, and compliance to the provisions of the pension reform Act 2014 by relevant government authorities.

The speaker, represented by the Chief Whip of the House, Hon. Mohammad Monguno said the Contributory Pension Scheme could boost the economy if well managed.

Gbajabiamila said the smooth operation of the scheme was important so that workers would not retiree and find it difficult to access their retirement benefits.

The Chairman, House of Representatives Committee on Pensions, Hon. Kabiru Rurum said the public hearing was aimed at finding solutions to the problems confronting the Scheme.

He said the National Assembly was concerned with alleged mismanagement of pension funds and ill-treatment of retirees.

The acting Director-General of the National Pension Commission (PenCom), Hajiya Aishat Umar attributed delay in the payment of pensions to Federal Government employees to the nonpayment of accrued rights.

“There are three components of the retirement savings account which are contributions, accrued rights and the yield on investment, they are to be consolidated before payment to retirees,’’ Umar said.

She said the number of contributors grew from 8. 14 million to 8.89 million as at December 2019.

Umar added that the total pension fund assets grew from 8. 64 trillion as at December 2018, to 10. 22 trillion as at December 2019, with an average monthly contribution of N131.69 billion in 2019.

She disclosed that more than 308, 298 people had retired under the scheme as at December 2019 and were currently being paid pension.

Umar said there were 957 Federal Government Ministries, Departments and Agencies (MDAs) under the CPS, comprising of 845 treasury funded MDAs and 112 self funded MDAs.

“The Federal Government was yet to implement the new rate of pension contributions in respect of employees of treasury funded MDAs from a minimum of 7.5 per cent to 10 per cent.”

According to Umar, there are 236, 676 private companies under the Scheme.

She said that the commission had developed a framework for recovering unremitted pension contributions with penalty from defaulting employers.

“The framework entails review of pension records of employers to determine unremitted pension contributions as well as incidences of late remittances.

“The commission had between July 2012, to January 2020 recovered the sum of N17. 054 billion,comprising unremitted principal contributions of N8. 644 billion and penalties of N8. 409 billion from 655 employers.”